Content

Greystar When the top U.S. apartment manager needed one system for their global investment and investor data, they chose Juniper Square. Serving investment partners across all asset classes, with solutions for funds and firms of every type. BNY Mellon is an Equal Employment Opportunity/Affirmative Action Employer. Our ambition is to build the best global team – one that is representative and inclusive of the diverse talent, clients and communities we work with and serve – and to empower our team to do their best work. We support wellbeing and a balanced life, and offer a range of family-friendly, inclusive employment policies and employee forums.

Any costs incurred before a project is assessed must be expensed as incurred. Costs incurred for the purpose of, but before the purchase of real estate are considered pre-acquisition costs. Tax and compliance reporting requirements are constantly evolving and becoming increasingly complex. They have in-depth knowledge retail accounting of local laws and tax regulation and will guide you through any changes and support you in developing new policies and processes to mitigate risks. Our global footprint and breadth of clients allows us to adjust to your investment lifecycle and to anticipate the right resources to meet your evolving business needs.

Are you ready for the new Regulatory Technical Standards?

We measure our success as a business, not only by delivering great products and services and continually increasing our assets under administration and market share, but also by how we positively impact people, society and the planet. Allvue’s industry-leading solutions can help your business break down barriers to information, clear a path to success, https://www.icsid.org/business/managing-cash-flow-in-construction-tips-from-accounting-professionals/ and reach new heights in alternative investments. A complete back office solution that combines detailed financial statement reporting, a true general ledger, cash management and workflow standards. Schedule of investments – An additional schedule disclosing each investment that constitutes more than 5 percent of net assets must be presented.

- Costs incurred before the project becomes probable cannot be capitalised if the project becomes probable afterwards.

- As the only independent outsourcer of design & construction accounting, we have developed comprehensive tools and operating procedures for local and global large-scale projects.

- The specific identification approach is most commonly used in minor projects to allocate acquisition and direct construction expenses.

- BNY Mellon provides a full suite of administrative services to support private equity funds.

- There are a couple of different ways to factor in depreciation when calculating your real estate profits.

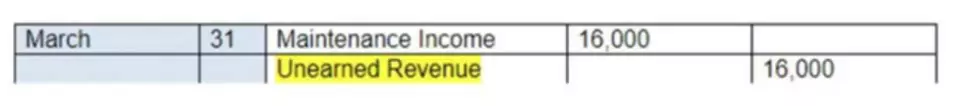

- In the accrual accounting method, selling costs are incurred in the sale period; therefore, there is no requirement for deferral.

- Know the numbers inside and out within your real estate investment portfolio.

This method is generally used for properties expected to have a long lifespan, like houses or commercial buildings. There are a couple of different ways to factor in depreciation when calculating your real estate profits. The most common method is the diminishing value method, which considers the shortened lifespan of a property as it gets older. Another way to account for borrowing costs is to calculate them into your expected return on investment. It will give you a more accurate picture of how much profit you can expect to make on your investment. These expenditures are not part of the facility’s acquisition, development, or building costs; they are start-up costs.

Ready to grow your business?

If you decide to sell one or more of your investment properties, you must understand the ramifications of CGT. Use the bank statements to extract charges and recurring loan costs , which are also deductible. Suppose you have a bank account dedicated entirely to property transactions. In that case, you may be able to deduct the costs of maintaining a bank account for banking rent and paying rental bills.

- Our customizable solutions, innovative technology and industry expertise will help support all of your cash management, payment, trade and global treasury needs.

- You can deduct the loan interest and most property expenditures from your taxable rental income if you borrow money to buy an investment property.

- The property must be rented or offered for rent for an expense to be deducted.

- Our design & construction, property, Propco, Holdco, SPV and fund solutions include a range of flexible service options that you can select to support your operations throughout every stage of your investment lifecycle.

If you are searching for a specialist real estate fund administrator whose trusted global capabilities allow you to focus on growing the value of your real investment portfolio, your search is over. CBRE Group, Inc. owns CBRE Global Investment Administration Luxembourg S.à r.l. Any investor concerned will be contacted by the Regulated Entity as soon as it has become aware of a Transaction. In the meantime, we strongly invite you to start gathering the documents listed above and to proactively contact the Regulated Entity via one of the business leaders indicated here. Our experienced professionals build on CBRE’s long history as the world leader in commercial real estate services and we have the expertise to meet our clients’ diverse needs.