Content

- What’s unique about the chart of accounts for an e-commerce business?

- Relax—run payroll in just 3 easy steps!

- Calculating sales and income tax

- Tax management

- e-Commerce accounting helps you understand your business’s financial performance.

- What does an ecommerce bookkeeper do?

- What is E-Commerce Accounting? A Comprehensive Guide!

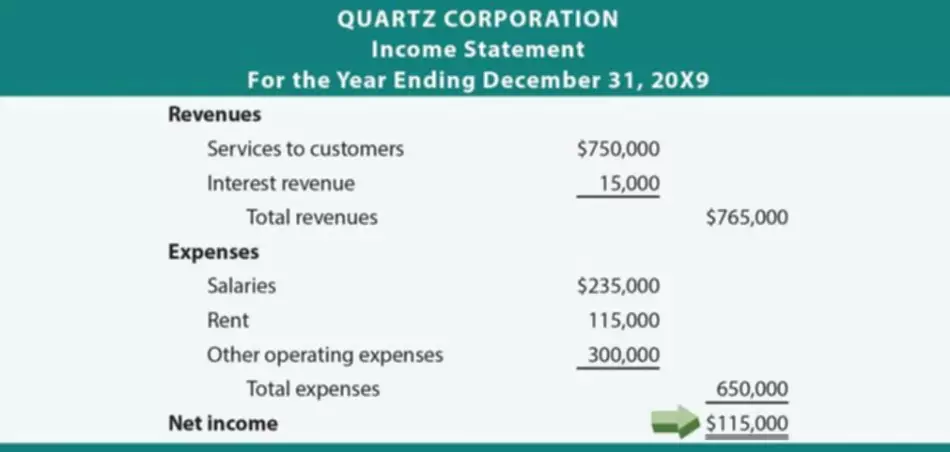

Most accounting software, including A2X, organizes your books using

accrual accounting by default, making it easier to prepare for your business’s financial ups and downs. Business accounting requires keeping track of all of a company’s transactions, inventory, and financial data. This includes metrics like cash flow and gross profits, balance sheets, and profit and loss (P&L) statements.

Fortunately, most of the best ecommerce platforms offer a way to manually track your tax liabilities. Some even provide you with tax reporting documents to file with the appropriate parties. Shopify is our top recommendation in this category, and the software has excellent tax automation tools for ecommerce businesses. In light of the complexity of bookkeeping for e-commerce businesses, many business owners will work with a bookkeeping service or a professional to ensure their books are accurate and complete.

What’s unique about the chart of accounts for an e-commerce business?

Digital commerce just passed the $1 trillion mark in a single year for the first time ever, according to Comscore. E-commerce hit $1.09 trillion in the U.S. in 2022, with the last quarter accounting for $332.2 billion, the analytics and measurement company said in an exclusive to Forbes. This doesn’t include travel, which would likely add a few hundred billion dollars of revenue. By the end of this guide, you’ll have the knowledge, strategies and tools you need to manage your finances like a pro, enabling you to focus on growing your business and achieving your goals. To simplify some of the process, you can use an accounting integration that automatically creates relevant sub-accounts and maps transactions to the corresponding sub-account. Download the extensive 58-page guide on how to spend less than an hour on your accounting and bookkeeping every month.

An ecommerce bookkeeper is responsible for recording, and categorizing transactions, and reconciling financial transactions for an e-commerce business. They manage accounts payable and receivable, track and manage inventory, and produce financial reports. They work to ensure the accuracy and completeness of financial records, and provide insights into the financial health of the business.

Relax—run payroll in just 3 easy steps!

Ecommerce accounting helps online business owners keep track of important financial data. It helps you understand where your money is going, so that you can make more informed decisions about your business. Pricing can vary for eCommerce virtual bookkeeping services, depending on how large and complex your business is. Large meaning the number of transactions you have on a monthly basis. Complex meaning the number of sales channels, banks, credit cards, and payment processors that you have. That being said, your ecommerce bookkeeping and accounting needs will differ as your business grows.

What is the 4 step process of bookkeeping?

The first four steps in the accounting cycle are (1) identify and analyze transactions, (2) record transactions to a journal, (3) post journal information to a ledger, and (4) prepare an unadjusted trial balance.

E-commerce sales tax is a complex and evolving area of accounting that online business owners must understand to comply with the relevant regulations and tax laws. Generally, ecommerce businesses are required to collect and remit sales tax rates on the sale of goods to customers in states where they have a physical presence or nexus. These services can integrate directly with your ecommerce platform and bank account, https://www.bookstime.com/ effectively automating a huge amount of bookkeeping labor and reducing the potential for human error. In this situation, your main goal before talking to potential virtual bookkeeping services is to get all of your financial information together. This includes, but is not limited to past tax returns, list of your bank accounts, list of credit cards, list of payment processors, list of sales channels, etc.

Calculating sales and income tax

Some 25% of shoppers return items purchased online, and the total cost of chargebacks across the globe is expected to reach $117.46 billion by 2023. You can choose to continue with our premium services if you are happy with the free trial. The client will be able to understand the skills of the eCommerce bookkeeper in the trial period. If a client feels their bookkeeper is unable to complete assigned tasks, we offer an immediate replacement.

Meet with us on a Kickoff Call so we can fully understand your eCommerce business and develop a strong relationship for the long run. We send you a Profit & Loss statement, Balance Sheet, and Cash Flow statement by the 15th of each month. We take care of keeping your books up to date throughout the month and keep you updated on anything that seems out of place. Once you have pricing quotes from each of your top options, it’s time to really dive into them and make sure that you have all of the information that you need in order to make a decision.

Tax management

However, as an e-commerce business, it would be useful for you to see these transactions distinguished from other costs or revenue from goods sold. Once you have selected accounting software, you must set up your chart of accounts. This will involve creating categories for income and expenses, such as sales revenue, cost of goods sold, advertising, and shipping costs. As an ecommerce seller, using accrual or modified cash accounting is recommended, which provides a more accurate picture of your cash flow and enables better financial forecasting.

- Because of Wayfair, state sales tax laws are determined by the state.

- As a global technology and financial services platform, we not only offer revenue-based financing — a type of flexible, zero-equity funding — for digital merchants.

- Frequent financial evaluations and strategic shifts in response to the market are necessary to keep the business growing.

- Many business owners may not be familiar with the financial business aspects.

- Before getting started with a vendor, however, you’ll need to choose an accounting method.

- This will put you in a great position to move on to Step 5 where you’ll evaluate the pricing from each company.

In 2022, 98% of business owners had a company website, compared to 50% in 2018. And more than 60% had an e-commerce business, meaning they sold products or services online. If you’ve been thinking about an online business, you need to know about e-commerce accounting.

e-Commerce accounting helps you understand your business’s financial performance.

It is also important to highlight that just because software exists does not mean it is easy to operate. Learning the operation and optimal usage of ecommerce bookkeeping any software can also prove to be a troublesome hurdle. This problem is further exacerbated by the speed at which the E-commerce industry operates.

- You can do this by importing a file, using a template, or manually adding sub-accounts.

- E-commerce businesses are required to register for GST, collect GST on sales, and file regular GST returns.

- Expertise Accelerated understands that despite its importance for the business, hiring a dedicated accountant is simply impossible for the majority of E-Commerce entrepreneurs due to the cost.

- Additionally, once a business is doing more than $25 million in annual revenue, it is required by the IRS to use the accrual method.

For example, you might create a monthly checklist of accounting to dos. This might include uploading your receipts and documentation to your accounting software, checking your inventory levels, and reconciling bank statements. Bank reconciliation could take just a few minutes if you’re using one of our accounting integrations. At the core of these is setting up a suitable, cloud-based accounting software. Switching to the cloud means you can access your data from anywhere and easily give access to others.

What does an ecommerce bookkeeper do?

Once the form is submitted, you can schedule your call with Bree to chat about how we can get you peace of mind around your ecommerce business financials. We take care of your ecommerce accounting and provide financials you can trust. Yes, GST (Goods and Services Tax) is applicable for e-commerce transactions in many countries, including Canada and Australia. E-commerce businesses are required to register for GST, collect GST on sales, and file regular GST returns. Failure to comply with GST regulations can result in penalties and legal action.

Accrual accounting should be used by larger businesses, especially those that have lenders, auditors or investors involved. Because we are 100% remote, we understand how to serve our ecommerce clients. We speak to our clients’ unique challenges by providing direct, timely answers to questions and concerns. We do this by via the best technology to help improve their experience. The table below shows some of the areas of accounting specific to ecommerce, along with why this is different from traditional accounting and some solutions you may want to consider.